Getting Started with AgentsMCP

Avishek Bhandari

2025-06-25

Source:vignettes/getting-started.Rmd

getting-started.RmdIntroduction to AgentsMCP

The AgentsMCP package provides a comprehensive implementation of the Agentic Neural Network Economic Model (ANNEM), featuring heterogeneous AI agents with neural decision-making capabilities, Model Context Protocol (MCP) communication, and dynamic network formation.

Installation

# Install from GitHub

devtools::install_github("avishekb9/AgentsMCP")

library(AgentsMCP)

#> Registered S3 method overwritten by 'quantmod':

#> method from

#> as.zoo.data.frame zoo

library(ggplot2)

library(dplyr)

#>

#> Attaching package: 'dplyr'

#> The following objects are masked from 'package:stats':

#>

#> filter, lag

#> The following objects are masked from 'package:base':

#>

#> intersect, setdiff, setequal, unionQuick Start Example

Let’s start with a simple ANNEM analysis using a small number of agents:

# Set seed for reproducibility

set_annem_seed(42)

# Run a basic ANNEM analysis

results <- run_annem_analysis(

symbols = c("AAPL", "MSFT"),

n_agents = 100,

n_steps = 50,

save_results = FALSE,

verbose = FALSE

)

# View summary

annem_summary(results)Understanding Agent Types

ANNEM implements six different types of heterogeneous agents:

- Neural Momentum: Trend-following agents with neural network enhancement

-

Contrarian AI: Mean-reversion agents with AI-based signals

- Fundamentalist ML: Technical analysis agents with machine learning

- Adaptive Noise: Random strategy agents with adaptive learning

- Social Network: Peer influence and herding behavior agents

- Meta Learning: MAML-inspired strategy adaptation agents

Creating Individual Agents

# Create different types of agents

momentum_agent <- create_annem_agent("agent_001", "neural_momentum", 1000000)

contrarian_agent <- create_annem_agent("agent_002", "contrarian_ai", 1000000)

# Display agent properties

cat("Momentum Agent:\n")

#> Momentum Agent:

cat("- ID:", momentum_agent$id, "\n")

#> - ID: agent_001

cat("- Type:", momentum_agent$type, "\n")

#> - Type: neural_momentum

cat("- Wealth:", scales::dollar(momentum_agent$wealth), "\n")

#> - Wealth: $1,000,000

cat("- Risk Tolerance:", round(momentum_agent$risk_tolerance, 3), "\n\n")

#> - Risk Tolerance: 0.165

cat("Contrarian Agent:\n")

#> Contrarian Agent:

cat("- ID:", contrarian_agent$id, "\n")

#> - ID: agent_002

cat("- Type:", contrarian_agent$type, "\n")

#> - Type: contrarian_ai

cat("- Wealth:", scales::dollar(contrarian_agent$wealth), "\n")

#> - Wealth: $1,000,000

cat("- Risk Tolerance:", round(contrarian_agent$risk_tolerance, 3), "\n")

#> - Risk Tolerance: 0.682Working with Market Data

The package can automatically download market data or work with synthetic data:

# Generate synthetic market data for testing

synthetic_data <- generate_synthetic_data(

n_days = 100,

n_assets = 2,

annual_return = 0.08,

annual_volatility = 0.20

)

#> Generated 100 days of synthetic data for 2 assets

cat("Generated", nrow(synthetic_data$prices), "days of data for",

ncol(synthetic_data$prices), "assets\n")

#> Generated 100 days of data for 2 assets

cat("Assets:", paste(synthetic_data$symbols, collapse = ", "), "\n")

#> Assets: Asset_1, Asset_2

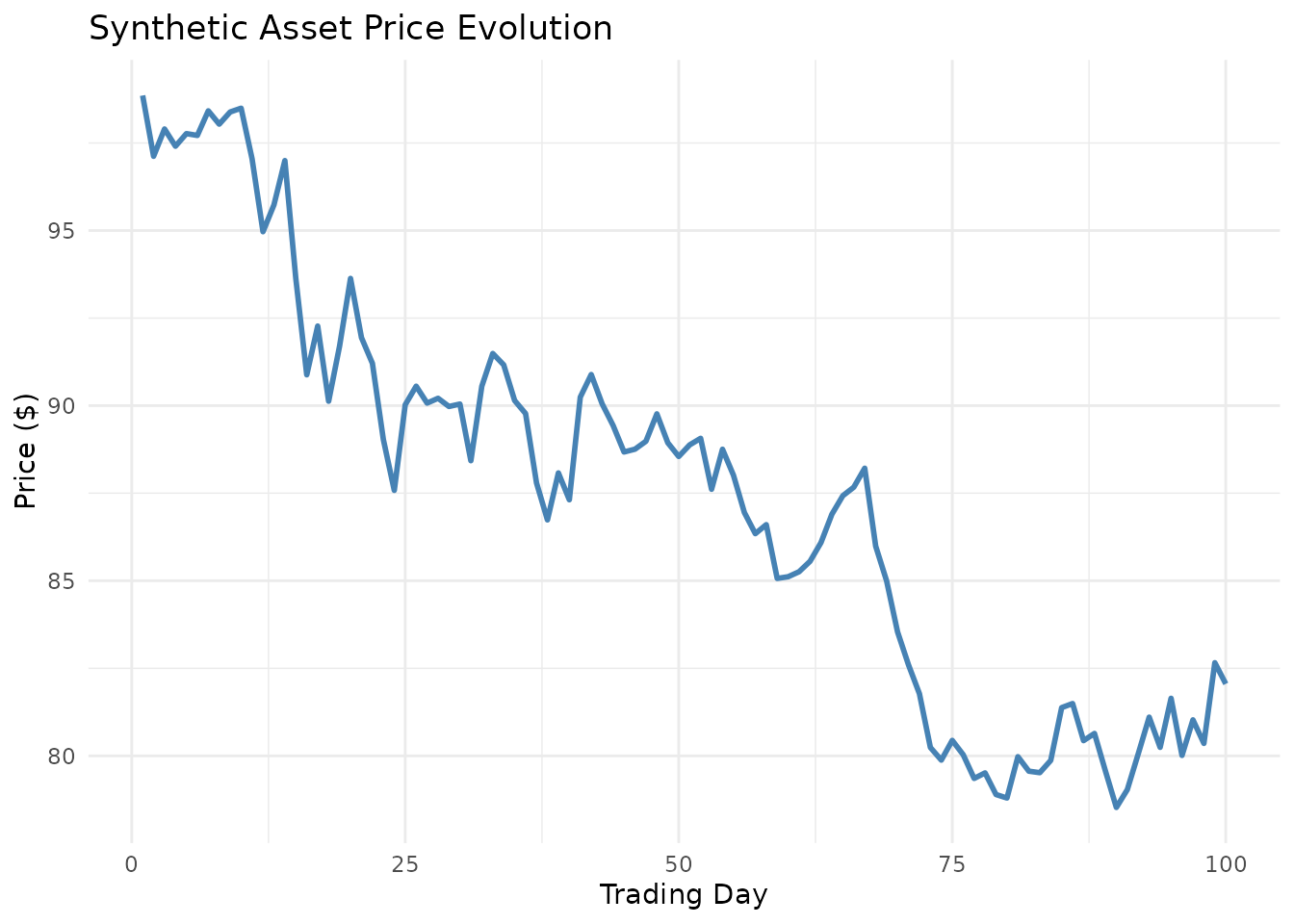

# Plot synthetic price evolution

if (requireNamespace("ggplot2", quietly = TRUE)) {

price_df <- data.frame(

day = 1:nrow(synthetic_data$prices),

price = synthetic_data$prices[, 1]

)

ggplot(price_df, aes(x = day, y = price)) +

geom_line(color = "steelblue", size = 1) +

labs(

title = "Synthetic Asset Price Evolution",

x = "Trading Day",

y = "Price ($)"

) +

theme_minimal()

}

#> Warning: Using `size` aesthetic for lines was deprecated in ggplot2 3.4.0.

#> ℹ Please use `linewidth` instead.

#> This warning is displayed once every 8 hours.

#> Call `lifecycle::last_lifecycle_warnings()` to see where this warning was

#> generated.

Creating and Running Market Simulations

Basic Market Creation

# Create a market environment

market <- create_annem_market(

n_agents = 200,

symbols = c("AAPL", "MSFT", "GOOGL")

)

# Examine the market

cat("Market created with", length(market$agents), "agents\n")

cat("Network density:", round(igraph::edge_density(market$network), 4), "\n")

# Check agent type distribution

agent_types <- sapply(market$agents, function(a) a$type)

type_distribution <- table(agent_types)

print(type_distribution)Running Simulations

# Run simulation with the market

simulation_results <- market$run_simulation(n_steps = 100, verbose = TRUE)

# Analyze results

cat("Simulation completed with", simulation_results$n_steps, "steps\n")

cat("Agent decisions matrix dimensions:",

paste(dim(simulation_results$agent_decisions), collapse = " x "), "\n")

cat("Wealth evolution matrix dimensions:",

paste(dim(simulation_results$agent_wealth), collapse = " x "), "\n")Performance Analysis

Agent Performance Metrics

# Analyze agent performance

agent_performance <- market$analyze_agent_performance()

# Summary by agent type

performance_summary <- agent_performance %>%

group_by(agent_type) %>%

summarise(

count = n(),

avg_return = mean(total_return) * 100,

median_return = median(total_return) * 100,

avg_sharpe = mean(sharpe_ratio),

.groups = 'drop'

) %>%

arrange(desc(avg_return))

print(performance_summary)Network Analysis

# Analyze network evolution

network_metrics <- market$analyze_network_evolution()

# Display network evolution summary

cat("Network Evolution Summary:\n")

cat("- Initial density:", round(network_metrics$density[1], 4), "\n")

cat("- Final density:", round(tail(network_metrics$density, 1), 4), "\n")

cat("- Average clustering:", round(mean(network_metrics$clustering, na.rm = TRUE), 4), "\n")Visualization

The package provides comprehensive visualization capabilities:

# Create performance plots

perf_plots <- plot_agent_performance(agent_performance)

# Display distribution plot

print(perf_plots$performance_dist)

# Create network evolution plots

network_plots <- plot_network_evolution(network_metrics)

print(network_plots$evolution)

# Create wealth dynamics plots

wealth_plots <- plot_wealth_dynamics(simulation_results)

print(wealth_plots$by_type)Model Comparison and Validation

Mathematical Framework Validation

# Validate implementation against mathematical framework

validation_results <- validate_annem_framework(market, simulation_results, agent_performance)

# Display validation summary

passed_tests <- sum(validation_results$Validation_Status == "PASS")

total_tests <- nrow(validation_results)

cat("Framework Validation Results:\n")

cat("Tests passed:", passed_tests, "out of", total_tests, "\n")

# Show any failed tests

failed_tests <- validation_results[validation_results$Validation_Status != "PASS", ]

if (nrow(failed_tests) > 0) {

cat("\nTests requiring attention:\n")

for (i in 1:nrow(failed_tests)) {

cat("-", failed_tests$Metric[i], ":", failed_tests$Validation_Status[i], "\n")

}

}Advanced Configuration

Custom Agent Distributions

# Get default configuration

config <- get_annem_config()

cat("Default Agent Types:\n")

#> Default Agent Types:

for (i in 1:length(config$agent_types)) {

cat("-", config$agent_types[i], ":",

scales::percent(config$agent_distribution[i]), "\n")

}

#> - neural_momentum : 20%

#> - contrarian_ai : 15%

#> - fundamentalist_ml : 18%

#> - adaptive_noise : 12%

#> - social_network : 25%

#> - meta_learning : 10%

cat("\nDefault Parameters:\n")

#>

#> Default Parameters:

cat("- Default agents:", config$default_n_agents, "\n")

#> - Default agents: 1000

cat("- Default steps:", config$default_n_steps, "\n")

#> - Default steps: 250

cat("- Risk-free rate:", scales::percent(config$risk_free_rate), "\n")

#> - Risk-free rate: 2%Performance Optimization

For large-scale simulations, consider these optimization strategies:

# For testing and development

quick_results <- run_annem_analysis(

symbols = c("AAPL"),

n_agents = 50,

n_steps = 25,

save_results = FALSE

)

# For production analysis

production_results <- run_annem_analysis(

symbols = c("AAPL", "MSFT", "GOOGL", "TSLA", "NVDA"),

n_agents = 1000,

n_steps = 250,

save_results = TRUE,

output_dir = "annem_production_results"

)Error Handling and Troubleshooting

Common Issues and Solutions

- Internet Connection: If market data download fails, use synthetic data:

# Fallback to synthetic data

tryCatch({

real_data <- load_market_data(c("AAPL", "MSFT"))

}, error = function(e) {

cat("Market data download failed, using synthetic data\n")

real_data <- generate_synthetic_data(n_days = 252, n_assets = 2)

})- Memory Issues: Reduce simulation size for large analyses:

# Check available memory and adjust parameters accordingly

memory_limit <- as.numeric(gsub("[^0-9.]", "", memory.size(max = TRUE)))

if (memory_limit < 8000) { # Less than 8GB

n_agents <- 500

n_steps <- 100

} else {

n_agents <- 1000

n_steps <- 250

}

cat("Using", n_agents, "agents and", n_steps, "steps based on available memory\n")Next Steps

- Explore the Advanced Modeling vignette for sophisticated analyses

- Check out the Network Analysis vignette for detailed network studies

- Review the Visualization Guide for comprehensive plotting options

- Visit the package documentation for complete function references

References

- Farmer, J. D., & Foley, D. (2009). The economy needs agent-based modelling. Nature, 460(7256), 685-686.

- Jackson, M. O. (2008). Social and economic networks. Princeton University Press.

- Billio, M., Getmansky, M., Lo, A. W., & Pelizzon, L. (2012). Econometric measures of connectedness and systemic risk in the finance and insurance sectors. Journal of Financial Economics, 104(3), 535-559.